Conducive government initiatives and focus on physical infrastructure like airports, flyovers, metro rail corridors and a vast network of highways and expressways, are fuelling rapid growth in smaller towns.

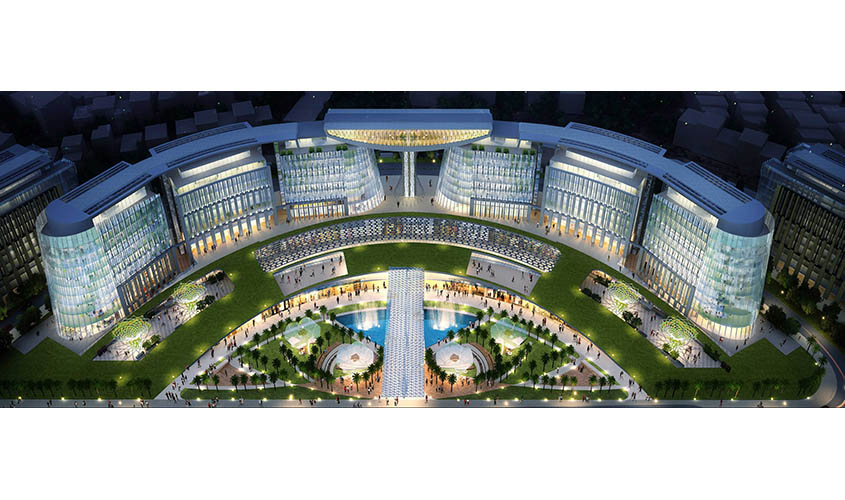

The real estate sector in India is set to take a major leap, thanks to a host of initiatives by the Centre and the state governments, including the ambitious Smart City project. As an outcome of the Smart City project, real estate, which was largely confined to metro cities, has begun expanding to tier-II and tier-III cities in states like Bihar, Madhya Pradesh, Chhattisgarh, Kerala and Odisha, among many other states.

Experts believe that the Smart City project, where there is a plan to build 100 Smart Cities, is a prime opportunity for real estate companies. As per estimates, India’s urban population is expected to surpass 850 million by 2050, of which 50% is expected to be in the age group of 19-58 years. With increasing disposable incomes and nuclear families, this will consequently lead to higher demand for housing and organised retail.

Smaller cities with high mid-income population base are the epicenter of untapped demand for residential units. High availability of land and that too at much affordable prices compared to metro cities come as an added advantage for real estate developers.

Considering the strong growth potential, ICICI Bank is also aiming to grow its home loan book by 33% to Rs 2 trillion and expanding its network to new locations in tier-II and tier-III cities.

From an investment standpoint, these cities offer better prospects. According to NHB Residex, on a year-to-date basis, tier-II and tier-III cities have witnessed better price appreciation compared to metros. For instance, property prices in Ahmedabad grew by 8.1%, in New Town (Kolkata) by 6.5%, Chandigarh (5.3%), Nashik (5.8%), while prices declined by 5.8% in Gurugram, Chennai (1.5%), Mumbai (3.6%), and remained constant in Kolkata.

Conducive government policies and focus on physical infrastructure like airports, flyovers, metro rail corridors and a vast network of highways and expressways, are fuelling rapid growth in smaller towns. For instance, the Smart City project plans to build 100 Smart Cities. Besides this, the National Urban Housing Fund has been approved by the Union Cabinet with an outlay of Rs 60,000 crore. Under the Credit Linked Subsidy Scheme (CLSS), housing for the economically weaker sections, lower and mid income group beneficiaries is being sanctioned under the Pradhan Mantri Awas Yojana (PMAY) Urban. The target is to cater to the demand of housing shortage of 1.2 crore (approximately) and fulfill the government’s vision of “Housing for All” by 2022.

Under the Pradhan Mantri Awas Yojana (PMAY) Urban, 6,028,608 houses have been sanctioned up to September 2018. In February 2018, creation of the National Urban Housing Fund was approved with an outlay of Rs 60,000 crore (US$9.27 billion). Under PMAY Urban, 1,427,486 houses have been sanctioned in 2017-18. In March 2018, construction of an additional 3,21,567 affordable houses was sanctioned under the scheme.

Well-established industries such as engineering, textile, pharmaceuticals and capital goods and growth drivers, including the availability of skilled labour at cheaper rates, and lower fixed costs/overheads in smaller towns, are leading to higher disposable incomes. Also, cities such as Chandigarh, Coimbatore, Vadodara, and Jamshedpur have become the hub of e-commerce, while Ahmedabad, Surat, and Vadodara have made huge progress in the industrial sector. On the other hand, Coimbatore has more than 25,000 SMEs, while Vizag has been suitable for industries such as mining, heavy manufacturing, etc. Jaipur has been leading in service sector investments.

Market experts said government initiatives to address grievances of buyers have also created an environment conducive to growth of the real estate sector. The Real Estate Regulatory Authority (RERA) has led to the realisation that the industry will be driven by end-users and investors will have a limited role to play. Consumers in tier-II and tier-III cities are currently underserved by the industry and these cities have a lot of latent demand for quality real estate at affordable rates.

Going forward, as RERA becomes an integral part of planning, developers will turn towards end users and shift their focus to these cities.

The Securities and Exchange Board of India (SEBI) has given its approval for the Real Estate Investment Trust (REIT) platform which will help in allowing all kinds of investors to invest in the Indian real estate market. It would create an opportunity worth Rs 1.25 trillion ($19.65 billion) in the Indian market over the years.

The real estate sector in India is expected to reach a market size of $1 trillion by 2030 from $120 billion in 2017 and contribute 13% of the country’s GDP by 2025. Retail, hospitality and the commercial real estate are also growing significantly, providing the much-needed infrastructure for India’s growing needs. Sectors such as IT and ITeS, retail, consulting and e-commerce have registered high demand for office space in recent times. Commercial office stock in India is expected to cross 600 million square feet by 2018 end, while office space leasing in the top eight cities is expected to cross 100 million square feet during 2018-20.