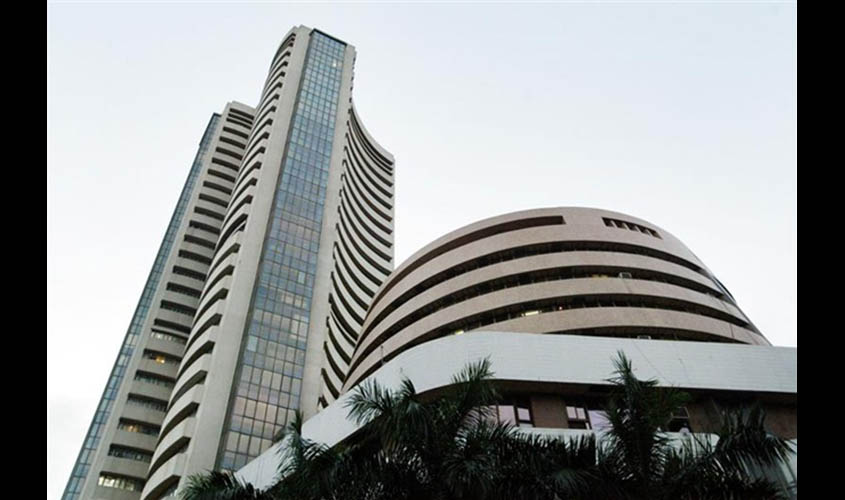

The Indian stock market is off to a strong start in 2019 and many market men are excited about the direction of it for the full year. A seasonal indicator called the “January effect” suggests that the positive market performance early in the year points to its trajectory for the rest of the year. A lot of traders and investors pay attention to how the first month plays out, as though it were a highly reliable indicator. But one big miss was during last year, when the indices had one of the best starts, only to suffer not one but three major corrections during the remainder of 2018. Sure, those who follow the stock markets are eager to see their favourite shares rebound and any such evidence pointing towards a positive 2019 is definitely likely to draw attention.

But smart global analysts are advising that you shouldn’t take the January effect seriously because even if stocks do post continued gains during the rest of the year, any link to the performance in early January will be tenuous at best. Most investors give their primary attention to the stock market because that’s where the big growth is.

However, stocks can be extremely volatile and hence most investors need other types of investment assets in their portfolio to balance their exposure to the financial markets and to meet their medium term needs. For most investors, adding bond schemes of select mutual funds to their portfolio can act as a counter balance to their stock exposure. A “bond” is generally an investment that’s tied to a loan between the bonds issuer and the purchaser. Under the term of the bond, the initial bond purchaser pays a set amount of money to the issuing entity. The issuer gets to keep the money and in exchange agrees to pay interest to the bond holder at set intervals, until the bond matures. Once the bond reaches maturity, the issuer pays the bond holder the principal amount back. A bond’s maturity date is set before the bond is issued.

Therefore, the investor knows upfront when they can expect to get their principal back. On the other hand, Bond Mutual Fund schemes are pools of investment in which a large number of investors can contribute money toward a commonly held portfolio of bonds. Regardless of different types, bond fund allows you to invest in a diversified portfolio of hundreds of different bonds (sovereign or private and of different durations) even if you have only a modest amount of money to invest. By grouping together a vast array of investors, bond funds are able to invest in a wide swathe of bonds efficiently and economically.

Investing in these bond funds makes sense for all types of investors as with stocks you can earn life changing wealth. Pick a wrong stock and you can lose everything. Bond funds don’t typically have that all or nothing nature.

Although the interest rates that most bonds pay don’t match up to the long term historical returns of the stock market, the relative stability that they offer provides a solid foundation for an investment portfolio. Investors can look at investing in debt mutual fund schemes during the current year of 2019 for added diversification and providing stability to the portfolio.

Rajiv Kapoor is a share broker, certified mutual fund expert and MDRT insurance agent.