INTRODUCTION

Since the last twenty years, our society has been a witness to augmented technological innovations and advancements. Our ability to better procure and perceive the data surrounding us has allowed us to cross new horizons and get access to a better understanding of the world we live in. These developments have resulted in a reflection of almost all that we do, into virtual and online outlets. Take, for instance, a basic function such as communication. Rapid developments in our technologies have allowed large scale interactions between populations with the help of social media.

The vast increment in our technological capacities has given rise to an increasingly digitized economy, where consumers often come across seemingly free services over the internet, for instance web-search services, which may be provided by a platform. In such cases, more often than not, consumers find themselves providing their data as a consideration for the services availed from the platform rather than paying a direct monetary consideration in exchange for the services. These platforms, in turn, monetize this consumer data by providing it to advertisers that use it to target consumers with personalized and relevant advertisements. It is an efficient system, reducing costs, both for businesses as well as consumers. Businesses can get better returns on investment, both in terms of resources spent on developing products the market wants and also in terms of advertising costs by reaching out to groups who are most likely to purchase those products. Correspondingly, it reduces a consumer’s search costs, i.e., the cost the consumer would bear to look for the good or service that would best satisfy his/her want (for e.g., consider the fuel spent on reaching the markets and the time spent on looking for the desired product).

However, the manner in whichoperation of these markets has manifested itself in this ‘Digital World’ may raise potential legal concerns. Competition authorities across jurisdictions are becoming more and more cognizant of the evolution and rise of new business models which are centred around the collection and processing of data in general, and consumer data in particular. Specific characteristics of the market, (such as disproportionately high returns to scale, network effects and the barriers to entry that may be erected as a result thereof) suggest that there is an increased likelihood of positions of entrenched market power, compared to traditional industries.

Given this fact, it is important to appreciate that while on the one hand, markets in the Digital Economy are rapidly evolving and pose new challenges, on the other hand, competition law is tasked with scrutinizing the conduct of participants in the market and as a result is reactive. It is, therefore, imperative that competition regulation keeps pace with new challenges that markets in the Digital Economy pose and not wait for the market to ‘stabilize’. It has been an accepted position that competition regulatory authorities cannot debar themselves from examining the position of an undertaking in an evolving and growing market pending its final consolidation, since this may mean an ex post acceptance of any abuses committed.

However, before delving into the application and dynamics of competition law in this area, it is imperative to understand the background and certain essential features of this new world order. Therefore, through this piece, one needs to see why increased interaction between competition law and the digital economy is going to be an inevitable trend in light of fundamental changes in the global business landscape and how increasing internet penetration across the globe, as well as India, has pushed India in the position of one of the fastest growing e-commerce markets.

DIGITAL ECONOMY: ESTABLISHING A TREND

The increment in Information and Communication Technologies (ICT) has been a primary driver of evolution for the Digital Economy which has led to a fundamental shift in the global business landscape. In 2009, the list of top 10 companies by market capitalization was dominated by companies in sectors such as oil and gas and telecommunications, with only one company operating in the information technology industry (Microsoft). However, there has been a fundamental shift which has been generated in less than a decade, where 7 of the top 10 companies in the world in 2018 operate in the Digital Economy, which includes Apple, Google, Microsoft Amazon, Facebook et al.

In order to capitalize on this growing trend, India has set for itself the commendable yet ambitious target of ensuring high speed internet penetration in the remotest parts of the country as part of the Digital India programme. The efforts of the Government towards increasing internet penetration in India seem to be paying off, as according to some estimates, internet penetration rate in India has increased to nearly around 50 percent in 2020, from just around 4 percent in 2007. If these estimates were to be considered, it would mean that approximately half of a population of close to 1.37 billion people have access to the internet in 2020.

Along with the rise in internet penetration, reports also estimate that between 2018 and 2023, the Indian e-commerce market would increase at a compound annual growth rate (CAGR) of around 41%, from INR 2,375.43 billion in 2017. This growing number of Internet users and a comparative increase in purchasing power are the primary drivers of growth of the e-commerce market in India, which some revenue estimates project to reach close to US$ 43,489 million in 2020.

LAYING OUT THE BASICS: SOME GENERAL FEATURES OF THE ‘DIGITAL ECONOMY’

Transactions over the digital economy are a global phenomenon. To understand the digital economy, several jurisdictions are coming up with market / sectoral studies under their respective legislations to understand the impact of this sector and best enforcement or regulatory strategies in their markets. Some of the noted that may be listed as a way of a representative sample are ‘Competition Policy for the digital era’ by European Commission in EU, ‘Digital platforms inquiry’ by Australian Competition and Consumer Commission, ‘Market study on E-commerce in India’ by the Competition Commission of India, market study for the ‘Online Travel Booking Sector in Singapore’ initiated by Competition and Consumer Commission of Singapore and ‘Market study of digital platforms’ by Swedish Competition Authority and ‘Vertical Restraints Project’ of the Unilateral Conduct Working Group (UCWG) of the International Competition Network (ICN). The latest in this representative sample of market studies is the final report on the market study of ‘Online Platforms and Digital Advertising’ by the Competition and Markets Authority of the United Kingdom, which was released on 01.07.2020. Some of the common themes emerging out of these markets are as under:

* EXTREME RETURNS TO SCALE: The digital economy presents a world of opportunity for many (such as small businesses) who can have access to a much wider consumer base / audience through the click of a button than would have been possible in any conventional sense. However, firms increasingly find themselves to be in a relationship with an “unavoidable trading partner” in these markets where the counterparty exercises market power due to possessing such enormous data. This happens in situations such as, amongst others, in the case when firms must transact over the internet using an architecture or platform that is a defining feature of a particular market. In digital markets, the cost of producing the information / service / value is much less than proportional to the number of customers served. This sets the stage for yet another feature of the digital economy—this is a sector where traditional operation of economies of scale are pushed to the very extreme.

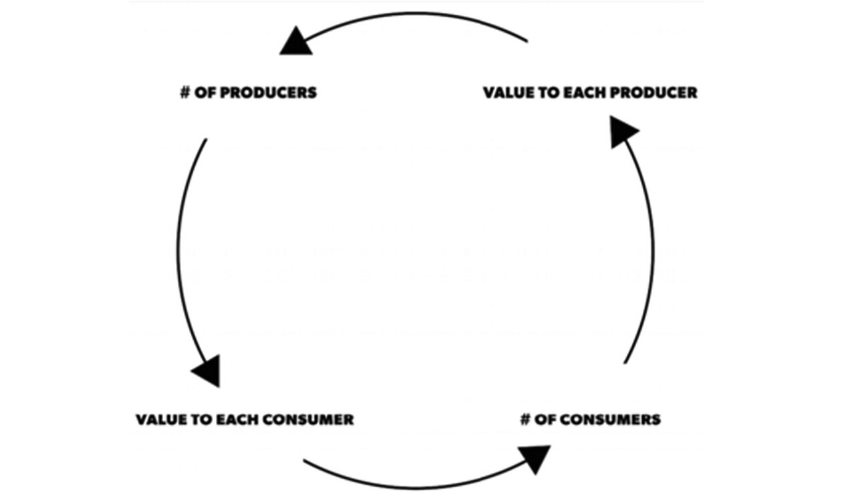

* NETWORK EFFECTS: Another defining feature of the digital economy is its propensity for network effects. Network effects are characterized as the increased usefulness of a service to the users as the number of users using the service increases. This creates a positive feedback loop for services that are offered, wherein an increase in the number of users / input to a service improves the value of the service to other users and therefore further attracts new users. This can be understood from the representation given here (Figure 1):

If we start from any of the points in the given circle, we see how the positive feedback loop comes into operation. For instance, the number of consumers contributes to the value derived by each producer in a platform. As the value derived by each producer increases, the number of producers finding the economic activity profitable also increases. Consequently, as more producers join the economic activity, the value to the consumer increases (for instance in the form of increasing choice in the market). This then further attracts more consumers, completing the loop. This is a self-reinforcing loop that can be seen in operation in case of platforms such as e-commerce platforms, wherein the number of consumers increases as the number of sellers providing different and more variety of goods increase, which consequently choose the platform to sell products because of access to more consumers. Network effects once established show a propensity to lock in users from both sides of the market.

The digital economy has provided a stage on which “platforms” have come to acquire significant roles. These platforms often connect two separate set of users, where each side of the platform is both a consumer as well as a product which is being sold to the other side. A classic case of network effects is experienced in telecommunications industry. Operation of network effects in cases of platforms are observed in case of platform service providers for social networking services, wherein a person joins the network only if a sufficient number of people are already part of the user base.

Creation of network, thus, is the new mantra. This is the precise reason why even after having nil or very thin profit margin, such companies continue to function on the same model and manage to get huge and multiple rounds of funding from sophisticated investors, The investor outlook has also undergone a fundamental change with network creation being primary concern rather than immediate profitability.

* THE POSSIBILITY OF TIPPING OF MARKETS: As we saw above, two fundamental features of the digital economy have been observed from our experience with it so far: it is characterized by extreme returns to scale and is prone to network externalities. These characteristics point to that fact that competition as deemed desirable in the traditional sense, whereby multiple firms providing similar services compete on the basis of lower prices and innovation, may not be compatible with the ways in which the digital economy unfolds itself.It is therefore possible that competition in the Digital Economy may manifest in the form of competition “for the market” rather than competition in the market.

There is yet another interesting feature of the Digital Economy. Since economies of scale and network externalities not only favour a concentrated market but also erect entry barriers, strong network externalities also present the distinct possibility of all consumers in the market deciding to opt for the product of a particular firm or for a particular technology, therefore leading to a “tipping” of the market in favour of that firm and entrenching a monopolist position in the market. Investments required to challenge a handful of incumbent firms which have managed to set up or sufficiently alter the “background architecture” of a market in its favour may therefore prove to be prohibitively expensive. Attaining critical mass of users can lead to firms assuming position of entrenched market power. In such markets, it becomes extremely difficult for new entrants (even if such firms does not face any dearth of capital) to dislodge the incumbent from its position. It is therefore imperative that firm activity is closely monitored by competition regulators to check how such firms obtain, what can be thought of as the escape velocity, to rapidly monetize disruptive innovations.Considering the same, the propensity of the digital world has been winner takes it all, which makes it all the more important that competition authorities take a clarion call to active expeditiously and proactively to ensure that such entities with market power conduct in a fair manner in the market

THE VALUE OF DATA: MORE THAN JUST A PENNY FOR YOUR THOUGHTS

As we saw above, big tech companies do not follow the conventional model of charging their customers to make a profit. Social networking platforms, e-commerce platforms and most of the google services are for free. The primary source of revenue for most of them is through advertisement. One of the ways by which consumers pay for the services is their data. Data is what these company require to provide better services, or more personalised service, which ultimately hooks the user to such services. To understand the role of data in this whole transaction, it is pertinent to take note of certain basics of the data economy.

The EC Competition Policy for Digital Era identifies three main channels for collection of data. First is ‘volunteered data’, which means data that the consumer wilfully provides to any enterprise. Second is the data that is ‘observed’, which is mainly behavioural data obtained by tracking user’s activity in digital space.

Data is the market power, often described now as the oil required for the engine of growth. Once an enterprise has enough number of users and their data, as well as capacity to convert such data into useful information, it is very difficult for a new enterprise to make entry in the market. Access to data for a long time may be used by a superior algorithm to improve their service and to attract even more users. For an example, users are unlikely to shift from Google towards any other search engine, despite enterprise like Microsoft are its competitor. Any attempt for the same would require a huge amount of resources.

The platforms which attract consumers for free or the negligible fee, target consumer using their data. The model on which their business works is ‘digital advertising’. The model, being different from traditional advertising model, targets consumers with personalised advertisement. This is the common business model for search engines and social networking sites. Google and Facebook are the largest companies working on this business model. The core methodology by which these online platforms work can be defined through the concept of attention economy, which works simply on attracting limited human attention. The online platforms, of every kind, works on this concept to engage the number of hours an individual spends on such platform. The CMA report explains this model though the chart below, where although the consumer does not pay money to the platform, but there exists transaction (Figure 2).

SOME SAMPLE INSTANCES OF FIRM CONDUCT IN THE DIGITAL ECONOMY

There are several possible ways of conducting itself in the market that open up for a firm having access to crucial data in the market.With a lot of data to process, an enterprise is given the opportunity to put itself in a perfect position to anticipate consumer needs and demand in more than one sector. Armed with this data, the firm can create its own product/ services which the data shows consumers may prefer.

Then there are instances where firms which act as platforms and connect two separate set of consumers may show a preference for products / services manufactured by the firm itself (for instance e-commerce platforms). In case of other platforms that simply provide a service of connecting two sets of users (such as social media or general search services), firms may choose to subsidize one side of the market to increase traffic and consequently the value for users on the other side of the market, choosing to earn from advertising revenues. It is a positive loop situation where considering the traffic on the other side, the advertisers will continue their engagement with platforms.

An enterprise is also presented with the opportunity to get access to more data by offering different services, which are highly complementary to the main service. AS a result, by operating such complementary services, firms have the option to create their own ecosystems which helps attract more users which derive value from the ecosystem.

Therefore, access to data opens a world of possible behaviours that firms may choose to adopt in the market. The possible competition implications of such conduct, such as creating entry barrier, lack of innovation, consumers paying higher prices etc, have generated an entire body of case-laws, market studies and research both in India as well as other jurisdictions.

Figure 2: Online Platforms and Digital Advertising, CMA, supra note 16.

Abir Roy is Partner, Sarvada Legal.

Figure 1 image source: What are Network Effects?