The illicit market in smuggled and counterfeit cigarettes is thriving in India, so much so that industry reports have claimed that the consumption of such cigarettes increased by 90% last year. Several studies conducted by the industry and frequent seizures at sea ports and airports have revealed that 17 billion cigarette sticks are smuggled into India each year. These much cheaper, smuggled and contraband cigarettes, which according to a FICCI study have doubled in the past one decade, cost a huge revenue loss to the national exchequer every year (over Rs 9,000 crore in 2015), apart from undermining the government’s campaign against smoking by making cigarettes increasingly expensive.

According to Euromonitor International, illegal cigarettes in India have more than doubled, having increased to 23.9 billion sticks in 2015 from 11.1 billion sticks in 2004, making India the fourth largest illegal cigarette market in the world and clearly a preferred destination for international cigarette smugglers.

Talking to The Sunday Guardian, industry experts said that high and discriminatory taxes coupled with extreme regulations such as pictorial warnings are providing a boost to the trade of illegal and counterfeit cigarettes in India. “The illegal cigarette trade is on a growth trajectory due to the high tax arbitrage. In addition to this, non-adherence of illegal cigarettes with regulations like pictorial warnings, lends an impression that they are safer alternatives to their legal counterpart,” Syed Mahmood Ahmad, director, Tobacco Institute of India (TII), said.

Illegal cigarettes or the duty-evaded cigarettes enter the Indian markets through sea routes and baggage and courier mode at the airports from countries like the United Arab Emirates, Bangladesh, Indonesia and China. The high profit margin has resulted in the frequent smuggling of these foreign cigarettes.

“The cigarettes that cost around Rs 100-150 for a pack of 20 sticks in Dubai and Bangladesh can be sold close to Rs 250. There are cigarettes which reach wholesalers at Rs 40-50 for the pack of 20 sticks. They sell them to retailers at around Rs 70-80, who in turn sell it for Rs 100-110. This is profitable for everyone compared to domestic cigarettes where you get peanuts in the name of profit,” a cigarette distributer in South Delhi told this correspondent.

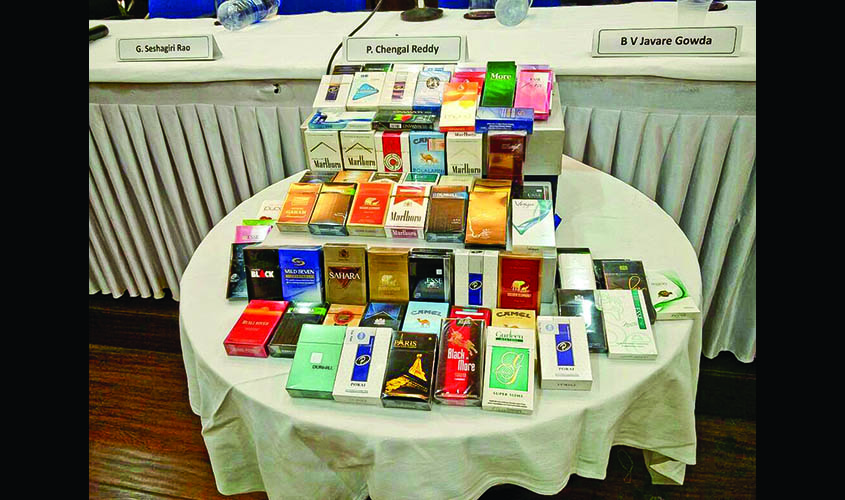

The distributor further revealed that most popular brands of these illegal cigarettes circulating in the market are Esse lights, Win, Gudan Garam, Marlboro, Camel, Dunhill, Paris, etc. Depending on the popularity of the brands, their prices have also shot up. For instance, Esse lights, Win and Paris cost Rs 100 per packet, while Gudan Garam and Dunhill cost around Rs 220 per packet. The current price of legal cigarettes (70mm-80mm) is over Rs 270.

“When I started smoking back in 2010, Classic Milds used to cost me Rs 95 for a pack of 20; now, it comes for Rs 260. I had to switch to Esse Lights which cost me Rs 110. ” said a 24-year-old call centre employee on the condition of anonymity.

While the illegal cigarette trade is on a growth trajectory due to high tax arbitrage, the legal cigarette industry continues to decline as a consequence of successive years of high excise duty rate increases, cumulatively going up by 125% since 2012-13.

Also, these illegal cigarettes do not comply with the excessively large 85% warnings on legal cigarettes, mandated by the government. As a result apart from the aesthetic appeal, this lack of warning creates an impression among the smokers that these cigarettes are comparatively less hazardous. “Almost every paan shop has close to 10-15 brands of smuggled cigarettes. These are openly sold at every nook and corner. They are low on prices and have no pictorial warnings, which makes one believe they are safer than the ones which have an image of a person with throat and lung cancer,” said Umendra Kumar Gupta, president Authentication Solutions Providers Association (ASPA).

Gupta further pointed out that these illicit cigarette brands keep changing the logo to avoid any accountability. “If you follow their market movement, you would notice that they change the logos every 2-3 months. This shields them from traceability,” Gupta added. This paper’s investigation further found that Win, claimed to be produced by Hongyunhonghe Tobacco from China, is not listed in the company’s website.

COUNTERFEIT CIGARETTES

While experts believe that illegal cigarettes may or may not be hazardous compared to the legal ones, the real menace is created by counterfeit cigarettes.

Counterfeit cigarettes, also seen as an “invisible enemy”, are the replica of the most popular and legal brands of cigarettes. Just like illegal or tax-evaded cigarettes, these cigarettes have a huge profit margin from distributors to retailers, sometimes as high as 30% at the wholesale level. When approached by this reporter for price quotations for various cigarette brands, a wholesaler in Noida revealed that while a carton (10 packets or 200 sticks) of original Marlboro costs Rs 2,400, the fake ones cost as low as Rs 1,700 (Rs 8.5 per stick). “I have a cheaper version of Marlboro and Benson & Hedges right now, but if you want the same in classic and Gold Flake, you have to wait for three months,” the wholesaler said.

A highly placed source in the industry told The Sunday Guardian that factories that manufacture counterfeit cigarettes do not repeat the brand to avoid tractability and crackdown. These cigarettes use low-graded tobacco with no compliance on levels of nicotine and tar to be used (1.0 mg of nicotine and 12 mg of Virginia tar as used by Gold Flake and Navy Cut). “It costs around Rs 20 lakh to set up a small warehouse to manufacture fake cigarettes. They use cheap tobacco; cheap quality of paper and God knows what amount of nicotine and tar. You can easily find these factories in Varanasi and Meerut. In one cycle they will produce a certain brand and in another cycle, they’ll change the brand to avoid a trail,” the source said under the condition of anonymity.

GROWING THREAT

Industry experts believe that the illicit market in cigarettes is not only a huge threat to the revenues of the industry and the government, but it has also had a devastating impact on tobacco farmers in the major Flue Cured Virginia (FCV) growing regions. “Since contraband products do not use locally grown tobaccos, the increased illegal trade depresses the demand for locally grown domestic tobaccos, thereby impacting the incomes and livelihood of tobacco farmers in the country,” said P.S. Murali Babu, general secretary, The Federation of All India Farmer Associations (FAIFA). The Centre has taken cognizance of the growing concern of the industry and the tobacco farmers over the rising trade in illegal and counterfeit cigarettes and has subsequently increased the vigilance on the borders. As a result, there have been multiple seizures in the past few months.

Last month, customs officials seized imported cigarettes worth Rs 10.38 lakh and Rs 38.65 lakh on two occasions in Coimbatore soon after seizing illegal cigarettes. Officials at the Directorate of Revenue Intelligence (DRI) also arrested three individuals for illegal possession of a large consignment of foreign brands of cigarettes worth Rs 15 crore last month in Noida.

However, experts believe that the government and the law enforcement agencies have to tighten security and conduct frequent crackdowns to curb the menace.

“India has porous borders which makes its vulnerable to smuggling. A tight vigilance is needed to tackle this ever-growing smuggling and counterfeiting of cigarettes in India,” said Deep Chand, advisor, FICCI Committee Against Smuggling and Counterfeiting Activities Destroying Economy (CASCADE). Last month, the TII had urged the government to slap high taxes on cigarette smuggling syndicates under GST norms to curb the illegal industry.