NEW DELHI :Every fortnight, scores of harassed and worried people from Delhi and Haryana gather at a common spot to discuss ways to recover cash plugged as fixed deposits with a Faridabad-based company that has gone bust. The total of cash lost in the FD scheme is estimated anywhere between Rs 100-150 crore, not big enough to be noticed in a nation that has the world’s largest number of newspapers and news channels. But the SRS Group has allegedly swindled a little over Rs 3,800 crore. And there is no news of the missing cash.

Yet, the SRS scandal has not triggered breaking headlines. Media’s near-total lack of attention has only helped Anil Jindal, CMD of the SRS group of companies, and others to remain quiet and even serve a short jail term.

The bottom line is very distressing, shocking. The SRS group of companies, which once functioned like a conglomerate—or at least pretended to function like one—and had in its kitty jewellery stores, cineplexes and shopping malls, is not even visible to anyone. Its Faridabad-based headquarters are now a barren structure, everyone has fled.

Lost in the melee is a whopping Rs 7,000 crore and the banks—led by the main lender, State Bank of India and Bank of Baroda—are wondering what has hit them and how to recover the lost cash. Repeated parleys with the promoters have failed. The promoters lost one insolvency case in NCLT, Delhi and then took the case to NCLT, Chandigarh because they realised late in the day that their headquarters were in Faridabad and that they should fight the case from Haryana. The NCLT judge in Haryana upheld the Delhi NCLT order and asked the promoters to pay up.

But there was no cash. Worse, the banks realised that all the buildings and properties shown as collateral by the SRS Group were actually on lease.

This is not the end of the story. India’s bizarre insolvency laws says in case of a loss, the banks have the first right to the cash and then comes the investors, described as per the law as “unsecured creditors”.

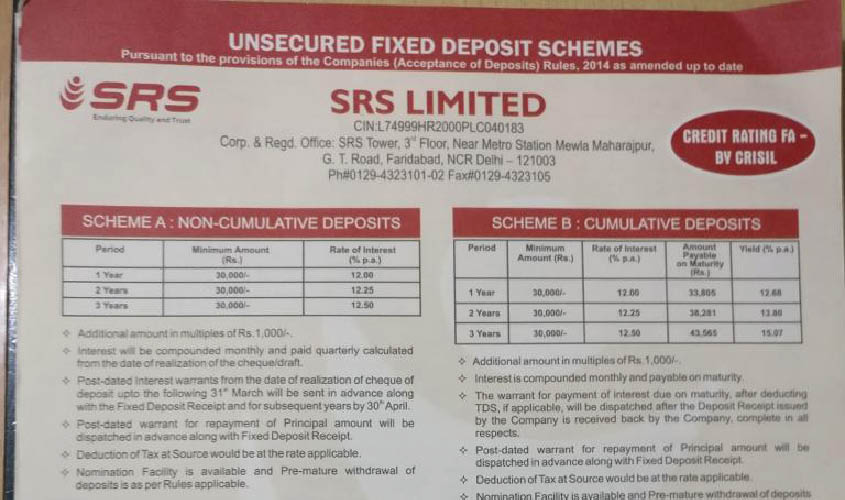

Sagar Deb, a retired engineer who had parked an estimated Rs 10 lakh as fixed deposit with the group, is wondering how to recover the cash. When the neatly-packed project details landed on his file with a small bronze Ganesha, it looked as the best investment option. The group has loads of businesses and banker to the FD scheme was Axis Bank, lead managers were IIFL, Karvy Stock Broking, SMC Global Securities & Almondz Global Securities.

“And then one day we realised we have been let down badly. Fixed deposit owners were not being paid, those who had booked homes did not get their apartments and everything else had, virtually, dried up,” says Deb.

Worse, unsecured creditors have been told by the resolution professional that they can, at the most, get only 5% of their FD.

As many as 120 cases of cheating and fraud have been framed against Jindal and other promoters of SRS by investors, who claimed they were duped of crores by Jindal and his company by not delivering promised flats, FDs and jewellery products. According to the complainants, the victims were promised flats in Greater Faridabad, Palwal and other parts of Haryana. The victims include those who had invested money in the SRS group in the hope of good returns. Cops say the company laundered cash by allegedly using hundreds of shell companies defrauding 17 banks and home buyers. In one of the glaring examples, the bank has served notices to 1,200 flat owners in SRS Royal Hills, Sector 87, Faridabad—constructed by SRS Group—to vacate the flats to recover the loan. The residents had been staying for years without even a registry.

Meanwhile, the FD holders wait for their near-lost cash.