Investors willing to invest in India set up shell companies in Mauritius and were essentially exempt from paying any capital gains tax as the island nation does not charge one and the DTAA gives tax collection rights to the country of residence of a company.

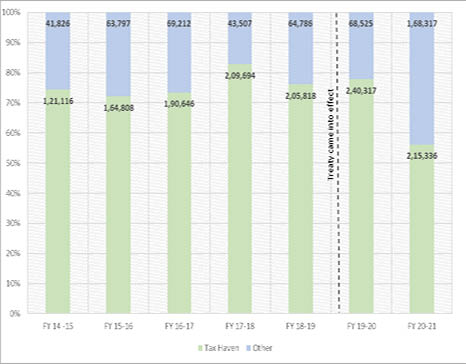

There have been two major developments in FDI to India in the recent years. First is the steep reduction in FDI routed through Tax Havens which is an important development because majority of India’s top sources for FDI have historically been tax havens which means that Indian government has lost a majority of capital gains tax for decades. This reduction is seen after the 2016 amendment of double taxation avoidance agreement (DTAA) that India had with Mauritius and Singapore.

Investors willing to invest in India set up shell companies in Mauritius and were essentially exempt from paying any capital gains tax as Mauritius does not charge one and the DTAA gives tax collection rights to the country of residence of a company. The amendment applied full tax rate under the Indian tax system on capital gains made by such companies after 2019.

Most news articles about the amendment talk about how the amendment will lose value because the investments will be rerouted from other tax havens. Cayman Islands (also a tax haven) coming out as a major FDI source after the amendment has also been discussed by many articles. I have shown, based on recent trends, that this hasn’t happened and the amendment has actually had positive impact on overall flow of FDI because the amendment was followed by expansionary FDI policies that made India more competitive in the FDI market and prevented the flow of FDI to other tax havens.

I have included tax havens that have frequently been on the list of top FDI equity sources in DPIIT data. These include Mauritius, Singapore (with one exception), Netherlands, Cyprus, and Cayman Islands. These are the countries I am referring to when I mention major tax haven sources below. Major non-tax haven sources include USA and UAE, again based on DPIIT ranking of FDI equity.

The second major development is the cumulative effect of FDI related policy changes, including corporate tax cut and opening of important sectors under 100 per cent automatic route, in the last five years. This has brought in new sources of FDI for India.

Trends

Cumulative FDI equity flowing in from major tax haven sources for India is at an all-time low at INR 2,15,336 Mn as of FY20. There has been a drastic reduction from all tax haven countries despite tax loopholes being fixed only with two countries. There are two possible reasons for this. First, a general expectation in the FDI market that India will plug in more loopholes in the future and might target agreements with other tax havens as well. This is contradictory to the general perception that the amendment will bring in more tax havens into picture.

Secondly, reduction of FDI equity from the above accounted for tax haven sources has not been rerouted through other tax haven channels but has in fact come in as investment directly (without round-tripping) to India, providing the government its due share of taxes. While Cayman Islands did emerge as a major FDI source since 2017 (which is reflective in the above graph as the continued high share of tax haven FDI in 2019-2020), its share has decreased in the latest batch of inflows and there has been no other tax haven that emerged since 2017. I found articles claiming that the FDI lost from Mauritius has been gained by Singapore but this can’t be the case since the same amendment has been made with Singapore as well.

As of 2020-2021, absolute increase in FDI equity from non-tax haven sources is more than absolute decrease in FDI equity from tax haven sources. The below graph shows a change in FDI inflows since FY19 when the historic corporate tax cut was introduced, which was preceded by opening up of sectors like insurance and mining under the automatic FDI route and other important developments in this regard.

In the below graph, the green bar shows increase in FDI equity in 2020-2021 from major non-tax haven countries while the red bar shows decrease in FDI equity from major tax haven countries. The blue bar shows the positive difference between the two which can be attributed purely to investment friendly policies and is over and above the investments rerouted from tax havens post policy change.

New Sources of FDI

Investment from Saudi Arabia has seen a steep rise in the last FY showing positive effect of deals with Saudi Aramco and other deals especially with Reliance industries. Saudi Arabia was the fifth largest FDI contributor in FY20. Investments from Saudi Arabia and UAE in FY20 together make middle east region an important FDI contributor, while it was not very prominent in India’s FDI scene before this.

Investment from Taiwan was also at all-time high in FY20 with Taiwan being the 16th largest contributor, the highest rank it has achieved as per RBI data. Inflow from Taiwan has been rising since FY18 after the Bilateral Investment Agreement was signed between India and Taiwan in 2018.

Investments from Spain in FY20 have exceeded the previous high which was in FY17. This marks the first rise after a two year decreasing trend. The rise cannot be accredited to any bilateral policy change.

Karishma Sharma is a researcher at the Strategic Investment Research Unit of Invest India, the national investment promotion agency of the GoI.