Inside the heads of the stimulus addicted financial markets dance visions of sugar plums as they anticipate another injection of monetary fentanyl.

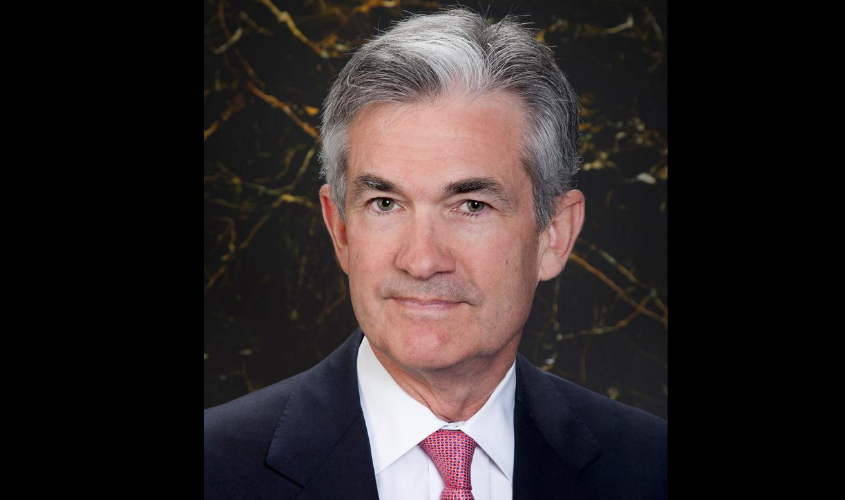

The chairman of the Federal Reserve, Jerome Powell, is the most powerful man in the world. His predecessors Alan aka “the Maestro” Greenspan, Ben Bernanke, and Janet Yellen run the most powerful organization on this planet: The US Federal Reserve Bank (“Fed”). The Fed is the US Central Bank and was created, after a series of financial crisis’s, by an act of Congress in 1913, which President Woodrow Wilson signed into law on December 23, 1913—that was the best Christmas present ever for Banksters. Appropriately, the idea to create the Fed was cooked up on Jekyll Island in 1910. The Fed is an “independent agency” which is not a bank and not a part of the federal government. These “appointed” Fed Board Members terms are fourteen year and worth millions of dollars to these members.

The decisions of the Fed’s nonelected officials impact not only the entire US economy, but by default every other central banks actions, financial market, and the global economy. These factors make the Fed the most powerful entity in the world. Policy decisions created, implemented, and enforced by the Fed’s cabal members need no approval from any elected officials. The Fed is owned its 12 regional Federal Reserve Banks, Quasi “Private Banks” set up around the nation. Commercial banks are legally required to own “shares of stock” in these 12 regional banks, for which the “member banks” receive dividends. While the Fed is supposed to be accountable to US Congress, over the years the Fed has morphed into rogue, recklessly speculative hedge fund who’s policies have caused: moral hazard, the technology collapse of the NASDAQ in 2001, The Housing 2007 crisis, and the great financial crisis. The coming crisis, which they will blame on COVID will end US dollar hegemony and destroy modern finance as we know it today.The Fed’s dual mandate by Congress is price stability and maintain full employment. Not The Fed have taken it upon themselves to manipulate market prices inflating the most grotesque asset bubbles in the stock, bond, property, and credit markets with Quantitative Easing and extreme money printing pushing their balance sheet beyond $7 trillion dollars—thus widening the wealth inequality gap to new records. The Fed’s actions have bailed out the banks and destroyed main street while eviscerating the middle class al together

At today’s virtual “Jackson Hole” meeting of the cabal of global central bankers the US Fed chairman is scheduled to speak. The title of his talk “Monetary Policy Framework Review” The mindless talking-heads in the fake news financial media have hypes Powell’s upcoming speech as the most consequential speech in history. Obviously, some of which must have been leaked in advance to the media. The media believe that the Fed will unveil a trial balloon, to potentially implemente a policy of average inflation targeting (AIT) which will allow the Fed more policy to see the inflation rate trend above the 2% target they have consistently missed for over 12 years. Powell’s Fed have claimed that they have ruled of negative interest rates, an insane policy that failed in Japan yet was followed by many other central banks around the world like mindless lemmings hurdling to their deaths straight over a financial cliff. Another possibility, my bet, that Powell may announce: Japan’s failed crazy economic policy of Yield curve control (YCC)—purchasing the majority of government debt produced by Japan to freeze interest rates. YCC, along with other failed economic policies, many of which were suggested by Paul Krugman, in Japan have caused Japan’s economy to collapse over the past 35 years. Were any lessons learned by the Fed from Japan’s policy failures? No, the Fed is copying their playbook.

An example of Fed predictions, policies, and why we should never again trust the Fed

* The “sub-prime” mortgage marketis contained”—Fed Chairman Ben Bernanke, 2007.

* The great financial crisis began about a year after Bernanke’s proclamation.

* “We will never see another financial crisis in our life-time —Fed Chairman Janet Yellen, 2017.

I could list many, many more. These Fed head’s predictions have been wrong over 80% of the time. Yet, since shill for the Bog banks and the .01% the fake news media roll them out to spew their latest narrative to the people with zero accountability, they have their 14 year guaranteed employment no matter what.

The Fed “can never taper a Ponzi scheme” and this reckless money printing and out-of-control bailouts have enabled moral hazard that will implode the global economy. This is MMT—modern monetary theory, which is modern day insanity and doomed to fail. It’s just a matter of time before the Fed feels it’s new mandate is to equalize social injustice it has caused with new powers. This is equally insane and will certainly not work and end in tears and the global financial system collapse as a result of the Feds reckless policies over the past 30 years. The government has seen how the central banks have printed hundred of trillions without consequence, now everybody’s doing it so the fed will be marginalized and blamed and the government will print money with reckless abandon to strengthen the oligarchs iron fisted grip on “society.”

Mitch Feierstein is an investor, banker and writer.